Fractional CFO Services

Your growing business deserves expert financial guidance without the cost of an in-house CFO

Signs You Could Benefit

From Working With a Fractional CFO

- It’s difficult to interpret the financial data for your business

- Lack of visibility into your business’s finances makes it hard to forecast & budget

- You struggle with pricing adjustments to account for inflation

- You need a trusted partner for objective, strategic guidance

- You lack time or resources to address crucial financial & operating tasks

- You lack strategic insight to analyze profitability, forecast cash flow, or track performance

- Your business isn’t growing because you lack finance or operating expertise

- You want to raise capital to fund growth or capitalize on acquisition opportunities

Services to Ease Financial Pain Points

Financial Reporting & Analysis

Improve profitability by understanding your numbers.

Is your business less profitable than it could be? Receive user-friendly financial results in straightforward language, not jargon. Using these reports, you will gain a thorough understanding and actionable guidance to improve profitability.

Cash & Debt Management

Keep your business safely afloat.

82% of businesses fail due to cash-flow issues. We’ll help you avoid becoming a statistic by managing and forecasting cash flow, obtaining financing, creating debt reduction plans, and identifying the best budget allocation with our cash & debt management services.

Planning & Forecasting

Plan for and predict the future.

Do you need a financial plan that charts the path to achieving your financial goals? What will your business look like 6 months or even 12 months from now? Plan for the future, measure performance, and identify resources and opportunities to grow.

Business Intelligence & Analytics

Turn information into insight.

Dive deeper into your data and track the most important metrics in real time. Make sense of large quantities of data to drive measurable improvements to your business. Plus, you will receive access to an executive dashboard that is accessible anywhere, anytime.

Decision Support

Make wise financial decisions.

Can you afford to hire more staff? Is the purchase you are considering a good investment? Should you sign that contract? Fractional CFO services take the guesswork out of making the best financial decisions so your business grows and maintains momentum.

Risk Management

Protect what you have built.

Do you have a backup plan if something goes wrong? Are financial controls in place to prevent fraud? Is your business adequately insured? We comprehensively assess risk and recommend ways to minimize your exposure.

Our Process

STEP ONE

Schedule a free 30-minute consultation

We will get acquainted so we can learn more about your business and needs.

STEP TWO

Get a Momentum CFO Financial Health Check™ assessment

During the assessment, we’ll define the scope of your project. This includes discovery, analysis, and delivery.

STEP TWO

STEP THREE

Receive your customized financial plan

Using the results from your Health Check, we’ll determine the CFO services required to meet your needs and present you with a strategic plan.

STEP FOUR

Benefit from ongoing Fractional CFO support

We will execute the plan to manage your finances, help you make wise financial decisions, improve your profit and cash flow, and conduct budgeting and forecasting.

STEP FOUR

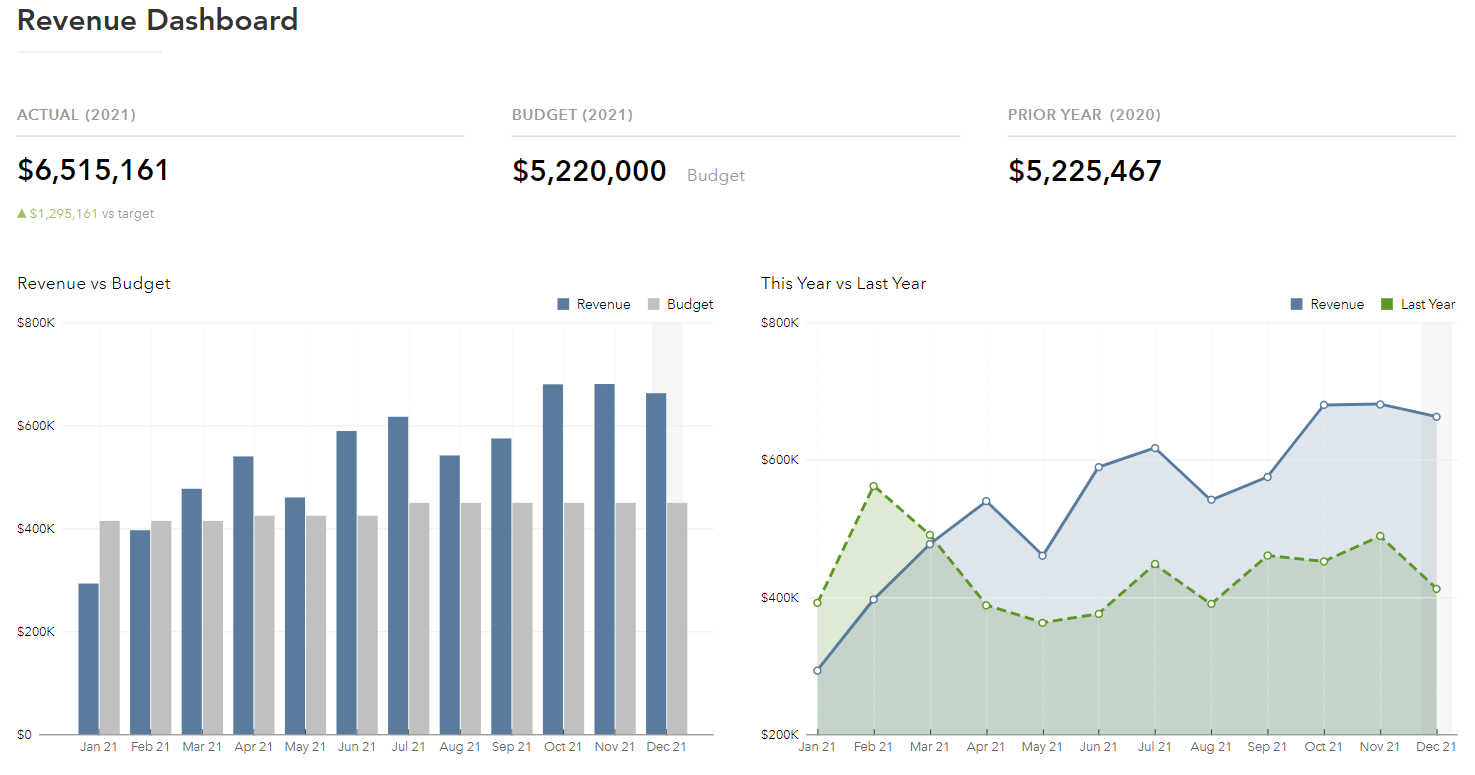

Turn Data Into Actionable Insights

Our dashboards illustrate your business’s most important trends.

Revenue Dashboard Example

- Was last month’s revenue higher or lower than budget?

- What does year-to-date revenue look like?

- How much has revenue grown compared to last year?

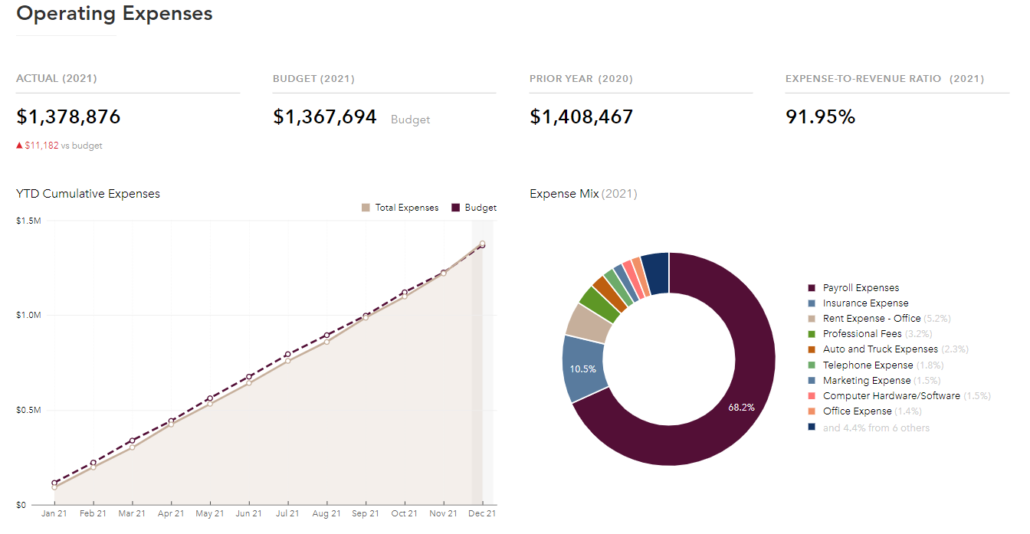

- Are your people spending more or less than budgeted?

- What are the largest expense categories?

- What are opportunities to reduce costs?

- Are operating expenses too high?

Expense Dashboard Example

What Sets Us Apart

Integrity

Operate with the utmost integrity and do right by your business

Collaboration

Work together with you and walk you through reports

Partnership

Treat you like more than just a number while we unpack the numbers

Top-Tier Service

Exceed expectations every step of the way

What Our Clients Say

Rosemary and her team possess deep knowledge in numerous areas like financial reporting, business intelligence, and data analytics. Momentum CFO will help your organization gain better insights and offer strategic recommendations to achieve your goals.

I would give Rosemary ten stars on a five star scale if I could. I am happy to refer anybody that I know to Rosemary’s work because of the high trust that I have in her and integrity of her work.

I brought Rosemary in to help my business when it was in a financial crisis. She immediately helped me right my ship by pinpointing vendors that were charging too much or failing to deliver. Rosemary evaluated my company’s financial situation, found issues that could lead to future problems, and created a plan to generate greater profit with less effort. Now my company is forward-thinking, and I know my finances are in good hands with Momentum

I gained invaluable insight from Rosemary’s financial reports and dashboards! They helped me make important executive decisions that increased our business’s revenue and profitability.

Rosemary is diligent, committed to high quality work, well versed in financial practices, and able to communicate complex information to any audience regardless of its level of understanding of financial statements.

Rosemary has gone above and beyond since the very start. She is incredibly respectful, systematic, detail oriented, and exceptional in every way. It is extremely reassuring to have her guidance on present and future financial health.

Rosemary’s spreadsheets are beautiful, in the sense that they are laid out very methodically and built with easy to read color coded cells in such a way that when you punch in numbers, you know where to look for answers. In addition, her advanced Excel skills and business acumen, which comes from working in various industries and companies of very different sizes, really helped me, the client, because she can get to the heart of the issue very efficiently and not waste time and money.

I must admit that I had no idea of the tremendous value a CFO could bring to my company until I hired Rosemary. Rosemary has been fantastic to work with over the past two years, and I have learned so much about financial metrics and reporting from her. Not only does Rosemary deeply analyze and report on every aspect of our business, she constantly provides suggestions on how to streamline and improve the financial health of the company.

My experience with Rosemary has been nothing short of insightful and meaningful. It has been a learning and development partnership between us. She has a wealth of knowledge that aids in my role at Cal Head & Neck. She is a great partner and collaborator and I am grateful to have her as a colleague.

Rosemary’s professionalism and attention to detail always impressed me. Her extreme attention to detail, building very complex financial models, and “teaching you to fish” approach is really incomparable.